At the beginning of this year, Arkansas lowered its state tax on groceries from 1.5 percent to 0.125 percent. A difference of 1.375 percent may seem inconsequential and barely noteworthy, but in Arkansas, the move to 0.125 percent marks the end of a 13 year long political process that started in 2006. On the campaign trail, Gov. Mike Beebe (D) vowed to incrementally lower the rate from 6 percent to 0.125 percent. Throughout Beebe's 8 years in office he continually fought to lower the tax rate, and the process was completed under his successor Gov. Asa Hutchinson (R). For lower income families in Virginia, that process never took place. Unfortunately, the Commonwealth of Virginia still unnecessarily taxes basic necessities such as food and water, requiring the most disadvantaged citizens to pay for a tax that raises little to no money.

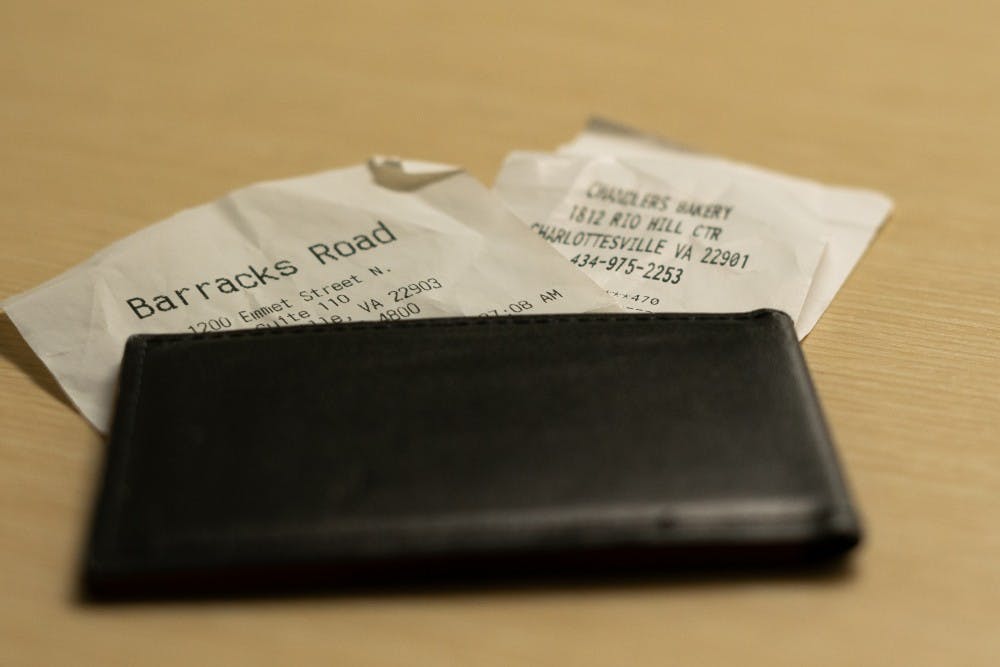

A “grocery” tax is a specific subset of the sales tax, or excise taxes levied on all products that are bought within a state, except for five states which have no sales tax. However, the majority of states carve out exemptions for necessary products, such as groceries. While Virginia's state sales tax ranges from 5.3 percent to 7 percent, the food for home consumption — or, "grocery tax”— is 2.5 percent. Although these numbers do not seem exorbitantly large, they place the greatest burden on low- and middle-income families due to their regressive nature.

A regressive tax is a tax in which the individuals in lower income brackets pay a greater percent of their income to the tax, rather than wealthy individuals who pay a relatively small portion of their income. Most regressive taxes are structured uniformly, meaning that everyone is charged at the same rate. A sales tax and more specifically a “grocery” tax are regressive and are the most detrimental as poor Americans can not simply eliminate food from their budget.

The Virginia General Assembly should reduce the sales tax to four percent and exempt all non luxury food items — meat, canned goods, vegetables, etc. — from the tax entirely. Lowering the sales tax rate and eliminating the tax on groceries would reduce the cost of living in all regions of Virginia, making the state more affordable for low income Virginians. If enacted, these tax reforms would be just as impactful as raising the minimum wage, because lowering both taxes would lessen the cost of living in Virginia for the poorest families.

The primary argument against cutting sales taxes concerns the shortfall in revenue it would create. However, eliminating the “grocery” tax would barely create a dent in revenue. The average American spends $2,792 on food per year, at a rate of 2.5 percent multiplied by the population of Virginia is approximately $600 million, or 1 percent of the Commonwealth’s budget. Furthermore, a reduction in the sales tax would cost $130 million, for a combined total of 1.5 percent of the total statewide budget.

$730 million is admittedly a lot of money, yet Virginia has a very large operating budget and an extensive taxable base. There are many ways to recoup $730 million. Raising the tax on cigarettes to $1 per pack, up from the current rate of 30 cents per pack, would net approximately $500 million in added revenue. This would also help save money on state health insurance premiums and generally improve public health, as the increase in price would force marginal consumers to buy less cigarettes. The remaining $230 million could be collected by raising the average state income tax, virginians who earn above 100,000, by approximately 0.15 percent. Raising the average state income taxes by 0.15 percent, for earners over 100,000 dollars, would increase state revenue by approximately $230 million.

The cost of reducing the sales tax and eliminating the “grocery” tax is not prohibitive, and finding state funds elsewhere — as in a higher tax on cigarettes and state income — would have fewer negative effects on the most underrepresented groups in Virginia. Furthermore, what I proposed is only one option of many — there are other ways to raise the necessary funding or scale back spending.

The majority of states have eliminated the “grocery” tax altogether, recognizing that it is neither fiscally prudent nor morally sound to tax the bare necessities such as food and water. While a flat tax on food for consumption sounds fair, it disproportionately harms the most vulnerable in our society. Instead of a family saving money towards a down payment on a home, low-income families are forced to pay a relatively high fraction of their income on everyday items they have to buy.

Addressing the impact of the “grocery” tax is not a new idea in Virginia politics. During his 2017 gubernatorial campaign, current Virginia governor Ralph Northam endorsed eliminating the tax for low-income Virginians.

Virginia must consider the needs of its’ poorest citizens, therefore I would urge Governor Ralph Northam and the General Assembly to follow the lead of 30 other states and exempt food from taxation, as well as to reduce the sales tax. Doing so would lower the cost of living for not just the poorest families but for all Virginians.

Matthew Baker is an Opinion Columnist for The Cavalier Daily. He can be reached at opinion@cavalierdaily.com.