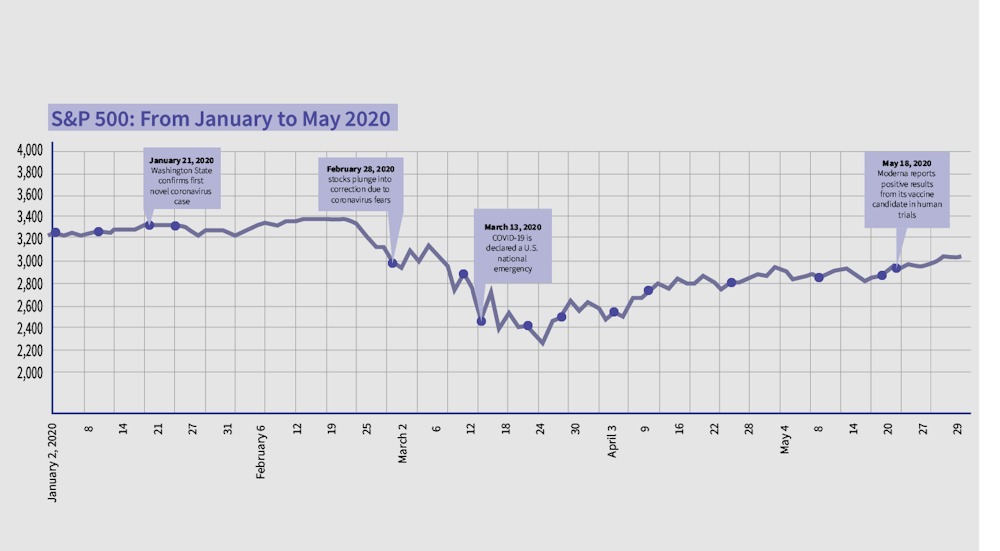

As the country began to shut down in March 2020, the U.S. stock market took a huge hit. From its early-year highs, the market had dropped 34 percent by March 23, 2020. In the following months, the market journeyed into an unprecedented cycle — one which Michael Gallmeyer, University professor of commerce and director of the Center for Investors and Financial Markets, said compressed five years into one.

A usual market cycle experiences a full transversal through an up-and-down market where down markets normally last one year and up markets close to four years, Gallmeyer said in an interview with The Cavalier Daily. Due to the abnormalities of 2020, the March drop placed the market in decline then it began an up cycle throughout the remainder of the year. By the close of 2020, roughly nine months after the pandemic declaration, the stock market was at record highs, contrasting with the fact that the economy had faced the worst yearly decline since 1946.

According to Ed Burton, professor of economics and finance at the University, part of the unexpected success of the market can be attributed to a small group of stay-at-home stocks, such as Zoom and Amazon. These stocks have become a significant part of the S&P 500 — the stock market index that measures stock performance in the 500 largest publicly traded companies in the U.S. The success of stay-at-home stocks has made up for the decline in industries like restaurants, retail and entertainment.

“Only those areas that could be done online thrived,” Burton said. “Now, interestingly enough, those areas got big enough and strong enough to carry the entire stock market to all-time highs … The stock market [is trading] well above where it traded just before COVID-19.”

Gallmeyer adds that it is not only stay-at-home stocks, but also sectors like home improvement that have amped up the markets. The most well-known are companies such as Home Depot and Lowe’s.

In addition to the impact of COVID-19 restrictions and changing consumer demands, the extent of government intervention in the markets has drastically changed the fates of some companies.

“Policymakers in the U.S. government as well as plenty of foreign governments … took a bet and said, ‘We can get past COVID … we want to figure out a way to preserve these businesses,’” Gallmeyer said. “‘Let's not let all these small businesses fail. Let's not let the airlines fail. Let's figure out a way to put them in suspend mode for a bit until we can get to the point that we can restart economies.’”

The combination of consumer changes and government intervention is what seems to have led to the unprecedented one-year cycle, which started with the tanking of stocks three months into 2020.

Over the following few months, government-offered recovery options and interventions by the Federal Reserve System — the U.S. central bank — propped markets back up. For example, the U.S. Congress passed the $2.2 trillion dollar Coronavirus Aid, Relief, and Economic Security Act in March 2020, which provided assistance to businesses and citizens and likely encouraged market investments, while the Federal Reserve bought up billions of dollars worth of corporate bonds to help large companies stay afloat.

Then in the months of July, August and September, technology companies predominately drove the markets while most other stocks lagged behind.

Despite its resiliency, the market became hypersensitive to news regarding vaccine trials and government bailout packages, which caused it to experience fluctuations.

“If there was a new government bailout package put in place, the market reacted strongly to that,” Gallmeyer said. “Any of the trials that came out about the vaccines were also big bumps in the markets.”

Following Pfizer’s early-November announcement that its vaccine was 90 percent effective after phase three trials, stocks surged as hopes of an economic re-opening increased. Additionally, the S&P 500 experienced a 12.5 percent increase from March 24-27, 2020 — the period in which the CARES Act was proposed and passed, according to research conducted by the Federal Reserve Bank of San Francisco.

Despite the market success, the U.S. economy experienced a much tougher response. This was exemplified by a 6.5 percent to 14.7 percent transition in U.S. unemployment rates from January to April of 2020 as increasing COVID-19 infections led to layoffs and slowed hiring. When it comes to the dichotomy of a successful stock market and poor economy, Gallmeyer notes that the market should be seen as an economic predictor.

“A good rule of thumb is [to] think about what you see happening in the stock market right now … as an indication of what's going to be happening in these economies six months to a year out,” Gallmeyer said.

In terms of economic predictions, the success of the recent markets can be attributed to three major aspects. Aside from government interventions which boosted companies that may have otherwise gone bankrupt, Gallmeyer emphasizes vaccine success and positive investor perceptions, otherwise known as market sentiment.

In comparison to the United Kingdom and the U.S., the European Union has experienced a lag in vaccine rollouts, and E.U. equity markets have taken a hit due to their slower ability to reopen. Because vaccine rollouts increase anticipations for an open economy by the end of 2021 and into 2022, heightened vaccination rates improve market sentiment. With a positive prevailing attitude towards the market future, Gallmeyer says that investors are seeing “light at the end of the tunnel.”

Now that the U.S. has surpassed a year since the initial market decline, Gallmeyer and Burton say it is hinting at a return to normalcy. Stocks that have gone into hibernation — industries like travel and leisure — are starting to come out of hibernation. Despite this reversal, stay-at-home stocks such as Zoom have likely been propelled five to 10 years due how quickly they have been adopted into everyday life. At the same time, Gallmeyer adds that the success of technology stocks should not imply that complete virtuality is the solution to running universities, businesses and corporations due to the importance of face-to-face interactions.

Now that hindsight is 20/20, Burton reflects on the unexpected nature of the market’s reaction to the coronavirus pandemic.

“By and large, the stock market seems to have benefited from COVID-19,” Burton said. “It had one of the most incredible rallies in the history of financial markets from March of 2020 to the current day. If anybody had asked me in March of last year [how COVID-19 economic restrictions would affect the stock market], I would have unequivocally told you that it would go down and have a very bad year, and in fact, it had one of the best years in history.”