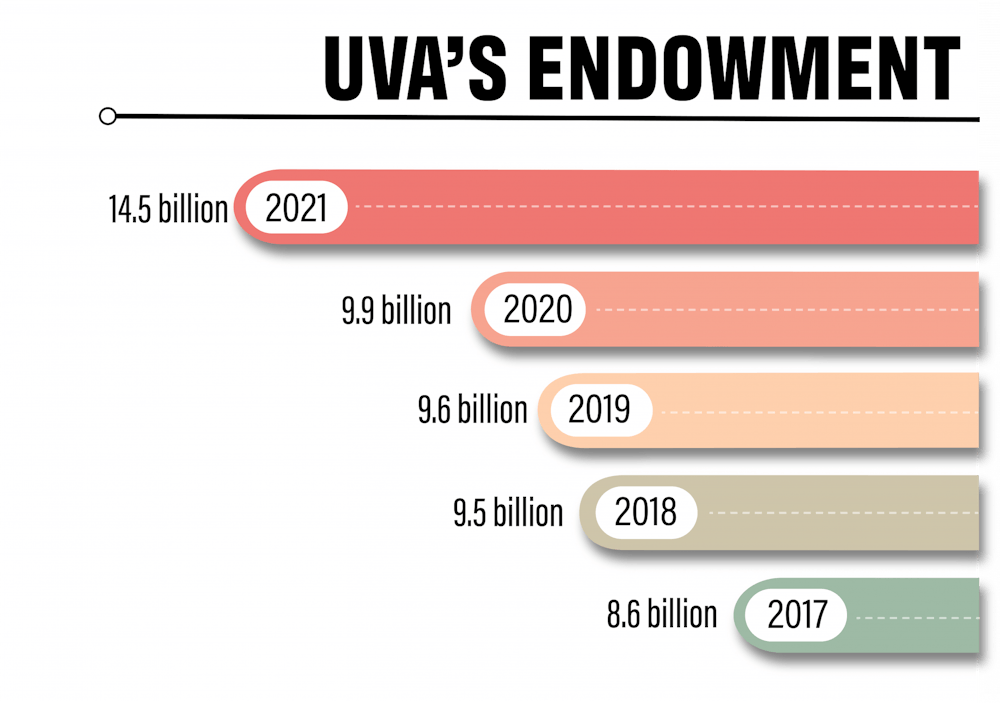

The University’s endowment grew markedly over the 2020-2021 fiscal year despite the ongoing COVID-19 pandemic, according to the University of Virginia Investment Management Company’s 2021 annual report. The endowment’s size currently stands at $14.5 billion, a 46 percent increase from its $9.9 billion valuation last year.

The University’s endowment is among the largest reported by public universities. The University of Michigan’s has reached $17 billion, and Texas A&M University’s is over $12 billion.

The endowment serves to provide a steady income that can be utilized to support the University’s goals.

“Endowed funds serve as a sustainable source of funding for professorships to recruit and retain distinguished faculty, scholarships and fellowships to support deserving students, lectureships to bring distinguished speakers to Grounds, library acquisitions and academic prizes to recognize outstanding students and faculty,” University spokesperson Wes Hester said.

Approximately 76 percent of the University’s endowment is restricted by donors who have a specific intent for the fund’s use, Hester said.

Its funding is derived from a group of investment funds known as the Long Term Pool, in which the University’s long-term funds are invested. The endowment makes up the largest portion at 52 percent, while the remainder of the Long Term Pool is made up of investments in University-associated organizations at 22 percent, the University Central Bank at 7 percent and other long-term assets at 2 percent.

“UVIMCO’s primary focus is finding great investment ideas and maintaining an appropriate risk profile for the Long-Term Pool, to generate superior, long-term, risk adjusted returns for the University and associated organizations,” UVICMO’s 2021 report reads.

The percentage of the Long Term Pool invested in the University Strategic Investment Fund — a source of funding for 61 distinct projects including COVID-19 disaster relief and funding for increased hiring for the Division for Diversity, Equity and Inclusion — decreased slightly from 18 percent in 2020 to 17 percent in 2021.

A portion of the Long Term Pool is used each year to support scholarships, professorships and research funds and to expand University programs and facilities. The remaining money goes towards building the Long-Term Pool’s market value.

The University’s investment process is regulated by UVIMCO, which secured a 49 percent return in the Long Term Pool, along with $161.2 million in its Short Term Pool for “near-term liquidity needs” in 2021.

Over the last 20 years, UVIMCO’s Long Term Pool had an annualized return of 10.6 percent compared to the 7.4 percent median of peer institutions.

The University’s $14.5 billion endowment fits into a pattern of universities nationwide reporting sharp gains during the 2020 fiscal year. The University of Illinois’ endowment rose from $2.03 billion in 2020 to $3.82 billion in 2021, and Pennsylvania State University’s grew from $3.4 billion in 2020 to $4.61 billion.

According to UVIMCO’s 2021 report, the 49-percent return of this past fiscal year caused a sharp increase in three and five year returns, which measure how much the investment has increased over time – these returns now surpass the University’s spending significantly.

Following the impressive gains made this past year in returns, Robert Durden, the chief executive officer and chief investment officer of UVIMCO, said these gains may reverse but affirmed the importance of this year’s achievements and his own confidence in the University’s financial well-being in the future.

“We expect a good deal of the value generated by the Long Term Pool over the past year to continue to provide U.Va. with the financial resources needed to fulfill President James E. Ryan’s vision of a University that is both great and good.” Durden wrote in the report.

This vision is outlined in the 2030 Strategic Plan and lists the steps University is taking to become the best public university in the nation by 2030. These include providing support for more diverse and talented students and faculty, strengthening relationships with the Charlottesville community and promoting interdisciplinary research.

“We will seize the opportunities presented and navigate the risks together to ensure the continued prosperity of the University for future generations,” Durden wrote.